All organisations face threats to their cashflow and profit.

Whether that is a declining market, changing consumer preference or technology evolution, or whole ecosystem challenges such as supply-chain limitations, regulation change, Brexit or coronavirus. It can also be as simple as higher than expected expenses and lower than anticipated sales, or an aggressive new competitor. Internal reasons for distress may include poor financial decision making, poor operational control, technical debt or an unengaged workforce.

Execs at the best managed companies meet regularly to scenario plan - that is to anticipate the emerging issues that could impact their business, and, as a result enabling responsiveness in the face of disruption.

Companies which use the time granted by the revenue which flows from successful products to develop new products or to enter adjacent markets, often find that their next big profit generator arrives just as the current one is beginning to dip in effectiveness. Innovation is key; without expenditure on R&D and market testing, that next big revenue creator may not happen.

Many nations have legislated to end sales of new internal combustion engines by 2030 or later. Companies reliant on this technology are still generating sufficient revenue to be able to invest in alternate energy sources, such as hydrogen or battery power. As one income stream fades, one or more should pick up - but only if sufficient innovation has created a new product or services to take the company forward, and this investment is made before new competitors enter the market.

Major newsbrands saw their income from the sales of daily printed newspapers dip dramatically as a result of people accessing news and opinion online. It took several years to develop an acceptable digital solution, and to monetise that solution, to replace the revenue that had sustained those organisations for many years. For Newsbrands there was an element of refusing to believe that a business model which had served so well for nearly 200 years could become irrelevant, and a disbelief that it would happen so quickly.

There are similar stories in many industries. The need for actual cash money when travelling abroad has disappeared for many business trips and leisure holidays; our bank cards now reliably work in other countries' ATMs and we can 'tap' to pay for goods and services. This had led to a significant decline in 'Foreign Exchange Bureaux'. The big switch for the music industry from analogue records to compact discs brought a huge increase in music purchase, starting a golden era that led music execs ignoring the emergence of other forms of digital recording, which itself then moved rapidly from 'owned' to 'streamed' business models.

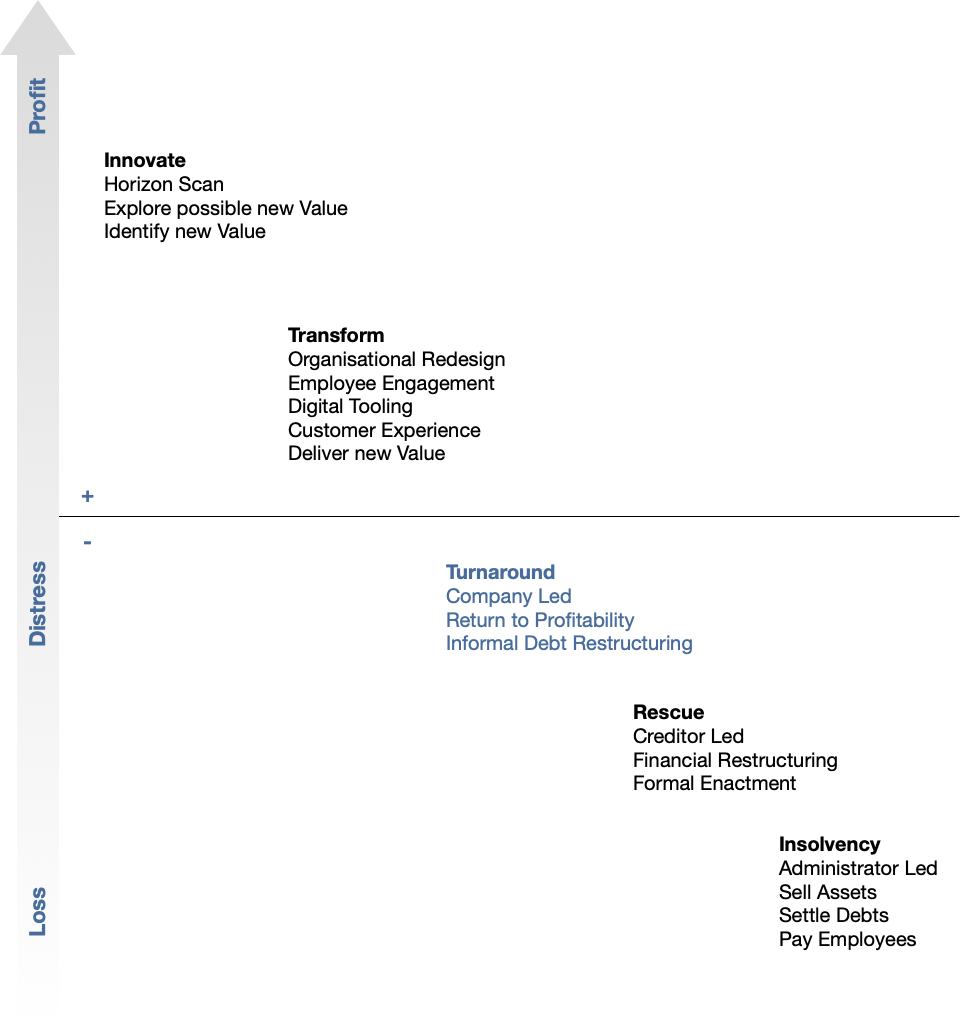

For some organisations there comes a point when the innovation hasn't worked, or the time to be able to innovate has passed. It may be that internal alerts on sub-optimal ways of working have been ignored, and operational performance is faltering. These signs of distress can be mitigated, and more time to prosper gained, if the company enters a period of transformation; put simply, every aspect of its operating model is examined and the non-value creating elements are removed. If the Exec is courageous then this transformation can result in a true step-change in capability, but it does take visionary leadership and a tight group of people at the top to make it work.

Distress

If the transformation opportunity is not taken, or is not sufficiently ambitious, or does not deliver the outcomes needed, then the company is likely to become distressed. At this point specific actions become necessary to avoid the inevitability of creditor rescue, or administrator closure or sale.

Turning a business around is the process needed to bring about those changes necessary to solve any of the business operational, strategic or financial problems that will restore the struggling business to its former trading viability. It's about transforming a loss-making company into a one which becomes profit-making again, by rectifying previous wrong-steps.

A turnaround is a company-led attempt to improve cashflow and to return to profitability. A business rescue is a creditor led debt-reduction and financial restructuring imperative. Both are preferable to insolvency or liquidation.

Company turnaround is a very visible, methodological approach to the revival of a organisation, one which takes time and money, and which needs the buy-in of all those involved - including the workforce.

Before any turnaround can start it is essential to understand the reasons why the business has declined. Some reasons will be self-inflicted, others triggered by external events.

Internal Reasons

Failure of leadership. Poor management of the business covers a multitude of sins, from opportunities missed or challenges not properly dealt with, through to neglect or incompetence. Sometimes a leader has been promoted, but is not properly prepared to perform the leadership role that they now hold. Sometimes the Tone at the Top reinforces poor behaviours in middle management or tolerates barely adequate performance in individuals, both to the detriment of company profitability.

Lack of employee engagement. A happy and motivated workforce is an important part of any successful business. If staff are disengaged, then there is a knock-on effect on how customers are interacted with. It is a sad reflection on the workplace that, on average, only 20% of employees are on-message and performing to the extent needed. The business case to make the best of the other 80% is unequivocal.

Lack of relevant tooling. Process excellence is reinforced through the use of well thought through technology, which also allows the workforce to operate at scale and distance. Unintuitive tools, poor connectivity and lack of relevance to the task in hand significantly reduce the effectiveness of the workforce.

Poor financial decisions. Weak budget setting, poor financial forecasting and challenges in managing cashflow can rapidly undermine an otherwise profitable business. A lack of controls can means that problems are not visible until they become a real impediment to stability. Financial modelling can help.

Market direction. All companies need to evolve to stay relevant as markets evolve and customer preference changes. Failure to track movement and to innovate can accelerate an organisation's decline.

External Causes

External events can significantly affect a company, no matter how well it currently performs. Some external causes of distress include:

Digital disruption. There are several elements in how the world currently trades that are fundamentally changing how businesses operate, each of which the senior team must understand, embrace and show leadership in.

Aggressive competition. An existing or new competitor enters your market, with a product with a price, function or quality which challenges yours, or a customer service which is much better than what your organisation offers. Manipulating the price is a race to the bottom, but upping how you deliver value can take more time than you find you have, even if you realise that you must take action to survive.

Asymmetric competition. Companies from outside your industry, who look nothing like your company, offer competing value to your customers. Mostly, you won't even notice these competitors, because they don't look like your company or your competitors. But they will be servicing your customers.

Supply Chain Price Increase. Suppliers at any point in the supply chain have the power to drive up the cost of the raw materials they supply your company. Any unexpected increase in the price of supply can have a very serious impact on cashflow, trading and profitability.

Customer Demand. Customers can force a company to lower its prices if they cannot see the value in the product that they wish to buy. Customers also have the power to purchase another company's product. Most customers will prioritise their purchase experience higher than price, quality or function. Any significant lowering of price per unit sold, or a long-term dip in the number of units sold can have a very serious impact on cashflow, trading and profitability.

Not all businesses facing failure can be rescued

A distressed company can only be saved if it has some basic building blocks for successful trading in place:

Core Competency. Any viable company, including those not currently distressed, needs an inherent trading strength; a combination of supply chain, products, distribution channels and customers - an efficient and profitable core. Every organisation's core offering must be distinct, and not easily replicated, with each characteristic contributing to the business' position in the market place. Understanding the necessary core competencies and having systems of measurement in place is essential to any corporate recovery.

Financing. Every business recovery needs an appropriate level of funding. An organisation must have sufficient cashflow and this may require access to short-term financing to allow the company to work towards its own upturn. No recovery can succeed unless and until the funding is in place to cover the expense of the recovery plan, plus a little contingency.

Appropriate Skills. Turning around the performance of a company needs retained knowledge, skills, and the right resources in place. Even with assured cashflow and a good core, no business can bounce back without the right people in post.

Turnaround Steps

Recovering a company in distress isn't as simple as making a handful of well-considered interventions. It is a non-trivial task, which needs a wide-range of skills and an objectivity and ability to act which is rarely present in the current leadership team.

Here are 7 steps to revive your distressed organisation:

- Situation Evaluation

- Distress Stabilisation

- Employee Retention

- Strategy Redefinition

- Product Improvement

- Process Improvement

- Finance Reset.

Situation Evaluation

The most important matter to determine is if your business is damaged beyond repair, or if it may be salvageable. Accurate and sufficient analysis must be done as soon as possible. You must discover what caused the problems you are having to deal with, and try to understand why they happened, before you attempt to mitigate them.

- Who are your core customers? Are they satisfied with the products or services you offer? Is it the right audience? Is the customer experience good enough?

- Are your products relevant to the market? Are they widely known about and easily available? Are they innovative? Do they offer sufficient value?

- What are the growth opportunities? Where can new value be added? What measures should be used to track new value delivered?

- Do you have the right people with the right skills in the organisation?

- Are the operational processes well-founded, relevant and efficient? Are they known and followed?

- How is your profit made? What is the margin? What are the levers to pull which affect margin?

Make sure that input is gained from a wide cross-section of people - customers, suppliers, management and staff. You must be prepared to hear unpalatable truths and to include them in your findings.

Distress Stabilisation

If the senior leadership team can see a path ahead, then there may be an opportunity to stabilise the business. Despite our desire to control everything, we cannot, so you must use the levers available to create windows of opportunity to take remedial action.

It is vital to maintain funding liquidity so that trading performance and associated finance can be improved in successive small steps. Each step should be targeted at delivering measurable value, thereby contributing to an ever more optimistic outlook.

Your creditors will need to see and support a realistic turnaround plan. You will need to be very honest as to how you got into this situation and what you plan to do to turn it around.

Employee Retention

The people employed by the company are the organisation, in many senses. They will all be fearful for the future and must be kept informed of the situation and outlook. This is just as true for those in the wider eco-system whose livelihoods depend on a recovery.

Ensure that each stakeholder fully understands and supports the situation, and the roadmap.

No turnaround can succeed unless the entire staff are performing well. Now is the right time to evaluate what roles are essential to future success and to understand who is performing to expectation, and who isn't. Removing the weaker links is a corporate decision, not a personal one. Decisions should be made dispassionately and actioned compassionately, when the time is right to do so.

Strategy Redefinition

Irrespective of market sector, delivering value to customers must be the prime purpose of any company, yet many companies struggle to differentiate or communicate their true value to the outside world - a reality which is particularly true of companies who are in distress.

Successful leaders understand that they need to find new ways to increase profits and reach new customers. The vision lays out a destination; the destination guides the strategy; and the strategy directs action. It’s action that leads to success.

Senior leaders of a distressed company must make objective changes in the approach which led to the downward spiral. Don't be tempted to try to fix matters which are of low value or that you can't control. Your company should spend 90% of available time on finding the right solution, and 10% fixing what is wrong. That is not to say that you skimp time on the implementing the solution, more that you do sufficient due-diligence to know that what you do fix will be an effective remedy.

The aim is to stabilise finance and maintain a positive cashflow, whilst creating a highly profitable core business.

Product Improvement

Take the steps in the Situation Evaluation a little further. You need to be offering your customers something that they can't find elsewhere, and with a customer experience that is better than the opposition. Focus must be on cashflow and profit, not the vanity of revenue.

Look at the cost of creating your products, and determine if any savings can be made.

Each product needs to evolve as the market matures and as customer preference varies; customers are fickle - they may love a brand one day and cast it aside the next. Sales must be improved without huge advertising spend.

Process Improvement

Take the steps in the Situation Evaluation a little further. Ask if the current business operating procedures result in productive work and an appropriate level of compliance.

When followed, do the work instructions make doing the job as straightforward and frictionless as possible? Are the procedures followed, and regularly improved? If not, do you know why not?

Is the working environment subject to the same levels of innovation and improvement as your products? Is the latest tooling made available?

Finance Reset

The most obvious indicator of a failing business is lack of revenue, but this is normally only a result of other matters that need correction. However, the problem of financing needs solving before any attempt to restore an organisation can be successful.

Don't buy anything that is not absolutely required. Give your cash control team a bigger mandate to say 'no'. Get better at debt collection. Improve inventory management so that you don't spend on stock that isn't immediately needed.

Most financial reporting tracks lagging indicators, which are of little use to you at this stage - they are history. Instead focus attention on the day-to-day actions which provide the inputs to the lagging indicators. Such as item-stock-days, number of units made, number of units shipped, time from order to shipping, number of customer complaints, average daily cash call, etc. You can then use this data to manage cashflow, with increasing confidence.

It takes much more money and effort to generate sales from new customers than from existing ones, so look at ways of getting current customers to spend more each time. Then look at how to get them to buy more frequently. Then look at how to increase the percentage of leads who become new customers. In every interaction ensure that the customer experience is as good as it can be, but put your crack team on ways of making it even better. All of these actions will keep the revenue, and profit, rolling in.

Before looking for external investment, which may have unwished for consequences, look at internal ways of releasing cash. For example cutting admin costs or putting some staff on short-time. Another option may be to sell part of the business or some non-core assets.

Stabilise New Operations

Your turnaround roadmap must be implemented with candour and resilience. If you keep doing the same things, you’ll get the same results, so you will need to be resolute about the company following a different path.

Remember that you have evaluated reality, determined on a course of action, executed those actions impeccably, monitored the results and refined the actions as necessary, discarding what is not working and doubling-down on what is.

Resist the temptation to focus on increased sales as the only route out of trouble. Never stop focusing on cash flow and never lose the discipline of daily measurement.

If the actions that the senior leadership team have taken turn out to have worked, then the company may slowly move out of its distressed state and into more regular business operations, once again generating profit. Take time to acknowledge the new ways of working, the sensitivities of cashflow and the staff's part in the journey.

It is even more important to continue to monitor key performance indicators and to develop a proportionate response to any warning triggers which are activated, to gain early insight of distress returning.

Turning around a distressed company has no guarantee of success. Congratulations are due if you can make this happen, but the true applause should be reserved for when you have taken the further steps necessary to make sure that this does not happen again. This may well entail embarking upon a formal Transformation Initiative and creating an Innovation capability.

Each organisation has its own unique way of working and may get into a distressed state and emerge from it in a way that is similarly unique. However well you and your team have done, there is no guarantee that taking the same steps will work a second time.

The turnaround approach is usually only workable in the early stages of poor performance and a business decline.

If the business is damaged beyond repair, then the only practical outcome may be rescue, sale or insolvency.